Reg. Trib. Milano n. 418 del 02.07.2007

Direttore responsabile: Elisabetta Brunella

![]()

![]()

International Edition No. 62 - year 5 - 12 May 2010

Special

issue on the occasion of the 2010 Cannes Film Festival

Special

issue on the occasion of the 2010 Cannes Film Festival

***

“MEDIA SALLES AT THE 63rd CANNES FILM FESTIVAL” MEDIA Salles latest data on digital cinemas and screens in Europe will be presented in Cannes during the European Audiovisual Observatory’s Afternoon Workshop: “Digital Cinema Tango! Getting the right rhythm for the digitisation of European cinemas.” Marché du Film 2010, Sunday 16 May 2010, from 3.00 pm to 4.30 pm at the Salle Buñuel, Fifth Floor, Palais des Festivals, Cannes. We are publishing here below the joint MEDIA Salles/EAO press release summarising the main findings of the MEDIA Salles survey on digitalisation in Europe as at 31 December 2009. More data and in depth information will be provided in the European Cinema Journal 1/2010, available on MEDIA Salles website from 16 May. |

PRESS RELEASE

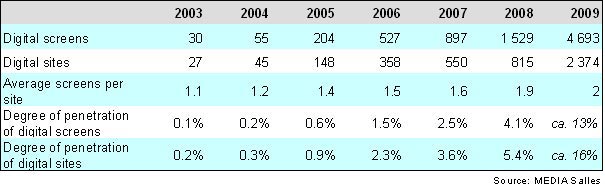

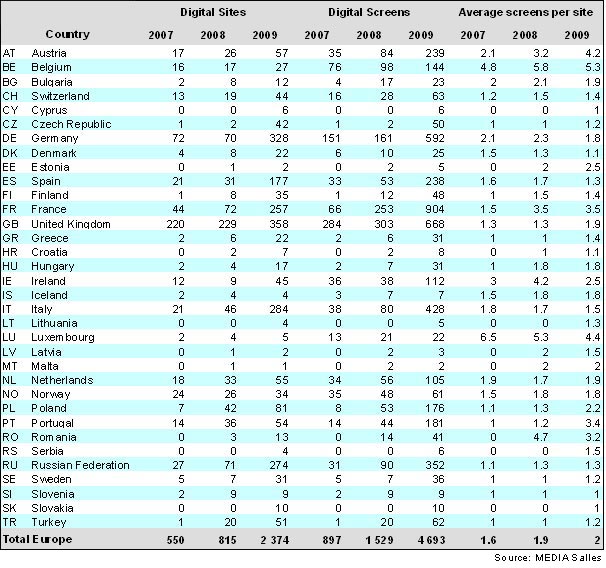

Record growth for Europe’s digital theatres: according to the statistics provided by MEDIA Salles the number of screens equipped with DLP Cinema or SXRD technology at 31 December 2009 came to 4,693 - a 206.9% rise compared to the previous year. 3D proved to be the key growth driver for the digitisation of screens as well as for overall box office. The European Audiovisual Observatory estimates that gross box office for the European Union increased by 12% year-on-year to a new record high of EUR 6.27 billion in 2009, largely thanks to premium prices for 3D screenings. Currently most digital theatres are to be found in Western Europe: as many as 3,904 screens, with a 198.2% increase compared to December 2008. The five leading markets in Europe in terms of admissions are also those with the highest number of digital screens: the top market, France, accounts for 19.3% of the digital total, the United Kingdom 14.2% and Germany 12.6%, followed by Italy with 9.1% and Spain with 5.1%. The remaining 789 digital screens are situated in Eastern Europe and the Mediterranean Rim, where there has been a considerable shift compared to December 2008 and a higher rate of growth than in Western Europe (+258.6%): the countries where the greatest development has taken place are Russia with 352 digital screens (7.5% of Europe’s total), Poland with 176 screens (3.8%) and Turkey with 62 screens (1.3%). Compared to the total number of screens in Europe, at December 2009 digital screens had achieved a market penetration of about 13%, as against 4.1% the previous year (table 1). The number of digital sites in Europe at December 2009 was 2,374, with a 191.3% rise over the previous year. The total market penetration of digital sites amounts to around 16% as against 5.4% in December 2008. Also on the increase is the average number of screens in digital sites which has risen in Europe from the 1.6 screens per site registered in December 2007, to 2.0 in December 2009. Table 1: Digital cinema sites and screens in Europe (as at 31 December)

The average number of digital screens

per cinema varies a good deal in individual European countries.

In December 2009 the highest figures were recorded in Belgium

(5.3 screens per cinema), Luxembourg (4.4), Austria (4.2), France

(3.5) and Portugal (3.4). The leading markets follow at some distance:

United Kingdom (1.9 screens per cinema), Germany (1.8), Italy

(1.5) and Spain (1.3). Table 2: Digital cinema sites and screens in Europe by country (as at 31 December)

In Europe the development of digital screens seems to be highly concentrated in terms of exhibition companies, in view of the fact that, at June 2009, 5% of exhibitors were responsible for 33.6% of the overall number of digital screens. The top five players are the French company CGR (with 13.1% of digital screens), Kinepolis (6.8%), operating in Belgium, France and Spain; Cineworld Group (5.6%), present in the United Kingdom and Ireland; Odeon and UCI Cinemas Group (4.8%), operating as Odeon Cinemas in the United Kingdom, as UCI in Austria, Germany, Italy and Portugal and as Cinesa in Spain; Cineplexx (3.4%), present in Austria and in Italy. The motor for the growth that took place in 2009 is certainly 3D cinema: as the North American industry has substantially respected the calendar of releases announced and audiences have proven receptive and willing to pay a premium price to take advantage of the novelty, exhibitors have invested in the technology that enables them to offer this new type of product. The penetration of screens equipped with 3D technology with respect to the overall number of digital screens has continued to increase: it was 54.4% in June 2009 and reached as high as 68.8% in December. In several countries in Central and Eastern Europe and the Mediterranean Rim, such as Cyprus, Croatia, Lithuania, Latvia, Malta, Serbia, Slovenia and Slovakia, where the numbers of digital cinemas are still modest, 3D screens represent almost 100% of total digital screens. In fact, the percentage penetration of 3D digital screens compared to the total number of digital screens is over 80% in many countries, such as Russia, Turkey, the Czech Republic, Denmark, Italy, Hungary, Finland, the Netherlands, Switzerland, Spain and Poland. The percentage is, however, lower in the United Kingdom, where it amounts to 70.8%, in Germany (62.3%) and in France (52.8%). __________________________________________________________________________________________________ Notes for

Editors: The European Audiovisual

Observatory, Council of Europe MEDIA Salles

Contact at MEDIA Salles: |

MEDIA Salles’ contacts and address

MEDIA Salles

Piazza Luigi di Savoia, 24 – 20124 Milano - Italy

Tel.: +39.02.6739781 – Fax: +39.02.6690410

E-mail: infocinema@mediasalles.it

Sito web: www.mediasalles.it

Contact

at the European Audiovisual Observatory:

Contact

at the European Audiovisual Observatory: